Our history

How the Deutsche Girozentrale (DGZ) became one of the largest investment services providers in Germany – the Deka Group.

Concert of the Federal Youth Orchestra at the company’s anniversary

The Deka Group celebrated its 100th anniversary in 2018.

Our financial institution in the economic miracle

Well equipped with a typewriter and telephone: a DGZ employee in the 1950s.

Where it all began...

Deka’s predecessor was founded in Berlin.

1918 - 1949 in the Deka chronicle

The year we were founded

and it promotes cashless payment transactions between the Sparkasse banks and giro centres (Girozentralen).

DGZ becomes a public banking institution

New branch in Frankfurt am Main

Additional function: Central institution for municipalities

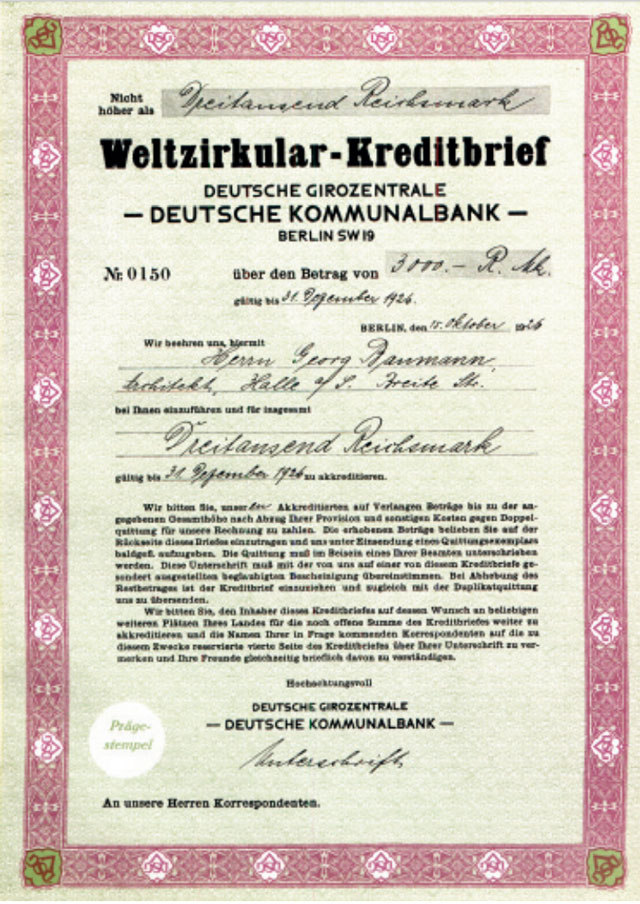

DGZ “Weltzirkular” letter of credit from 1926

DSGV and other responsibilities

DGZ becomes legally independent

Deutsche Sparkassen- und Giroverband (DSGV) continues to bear unlimited liability.

Political restrictions on municipal lending

DGZ in the Soviet sector

New office in West Berlin

A “transferred financial institution”

The DGZ building in Berlin was destroyed in the Second World War.

1950 - 1989 in the Deka chronicle

Active in Düsseldorf again

Formation of Deka Deutsche Kapitalanlagegesellschaft mbH

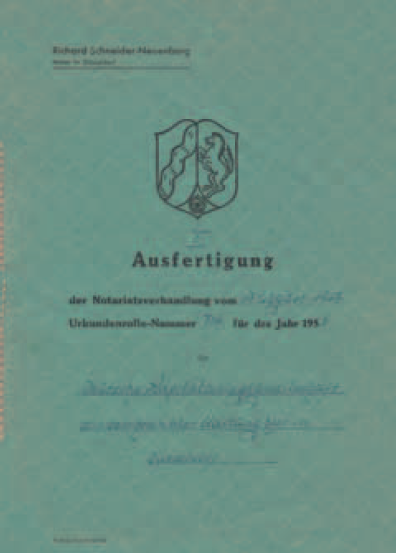

Deka formation document

17 August 1956

Move to Frankfurt

DGZ moves to its new headquarters to Taunusanlage 10, Frankfurt am Main in 1965.

Deka and DGZ move to Frankfurt

New line of business for real estate funds

Start in the European market

Hello Luxembourg!

New subsidiary

1990 - 1999 in the Deka chronicle

Movement to the new federal states of Germany

Another subsidiary in Luxembourg

Investment funds for institutions

Deka in Switzerland and formation of Deka GmbH

New structure and new names

Ernst-Otto Sandvoß

1971 to 1975 Member of the Board of Management, 1975 to 1999 Chairman of the Board of Management of DGZ and first Chairman of the Board of Management of the merged company DGZ/DekaBank.

Major merger

2000 - 2009 in the Deka chronicle

A new name for a new century: DekaBank Deutsche Girozentrale

Interest in WestInvest increased

DekaBank adds exchange traded funds (ETFs) to its range of products

First environmental report

2010 - today in the Deka chronicle

Deka becomes more sustainable

Some structural changes also take place. Starting 8 June 2011, the German savings banks become the sole owners of DekaBank.

Transformation on the agenda

UN Principles for Responsible Investment (PRI)

Deka signs the PRI in 2012, thereby recognising the special importance of sustainability factors

New markets and strong principles

The new “Deka Investments” logo

Deka pools its products and services in the securities business under the new Deka Investments umbrella brand in 2014

The new “Deka Investments” brand

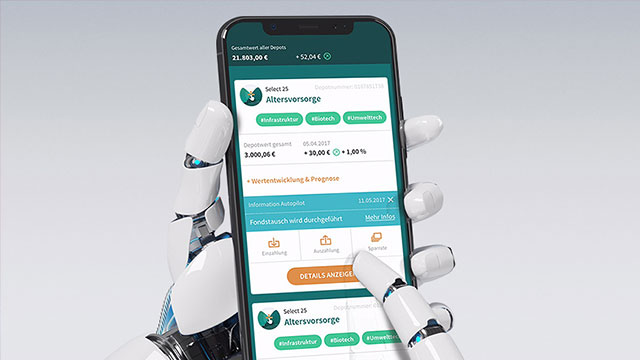

Deka enters the digital business

Robo-Advisor bevestor

Digital asset management

100th anniversary celebration

President of Germany Frank-Walter Steinmeier, President of the German Savings Bank and Clearing Association (DSGV) Helmut Schleweis and former Deka CEO Michael Rüdiger